Bitcoin’s November 2024 Cycle: The Ultimate Investment Opportunity?

In the realm of cryptocurrency, all eyes are on Bitcoin as it gears up for its next significant move. According to seasoned crypto analyst CryptoCon, a fascinating pattern is emerging—one that could signal a substantial bull run come November 2024. In this article, we delve into CryptoCon’s insights, exploring the “mid-cycle lull” and the intricate dance of Bitcoin’s cycles.

Bitcoin’s November 2024 cycle: The Nov. 28, 2024 Projection

Based on the cycle theory, Bitcoin enthusiasts are eagerly awaiting the D-day for Bitcoin’s November 2024 cycle. Historical data reveals that Bitcoin’s peaks and valleys often align with this critical date, sending ripples through the crypto market. But what makes this upcoming date so special?

Deciphering the Cycles

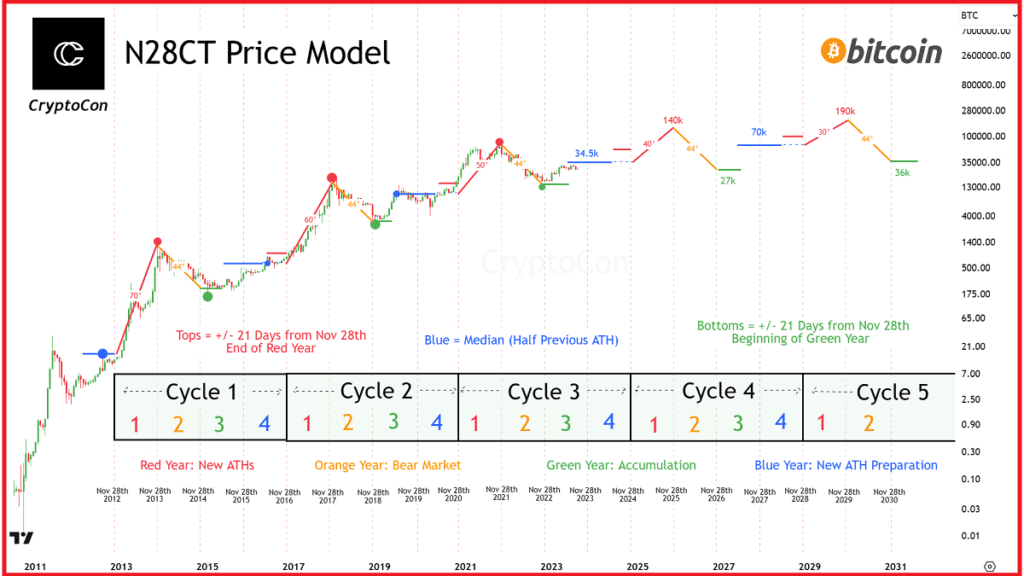

CryptoCon, a renowned name in the crypto world, has turned heads with his ” Bitcoin’s November 28th Cycles Theory.” This theory revolves around the idea that Bitcoin operates in distinct 4-year cycles, a phenomenon dating back to its first halving on Nov. 28, 2012.

According to CryptoCon’s model, the initial bottom of Bitcoin’s price trajectory was on Oct. 8, 2010. From this point onward, Bitcoin’s cycles have consistently peaked every four years. What’s intriguing is that these cycles exhibit a fascinating pattern—tops and bottoms occurring within a roughly 21-day window centered on the pivotal Nov. 28 date.

Bitcoin’s November 2024 cycle is revealed.

To gain deeper insights into Bitcoin’s November 2024 cycle, let’s dissect it. After each bottom, Bitcoin embarks on an early upward trajectory, paving the way for what CryptoCon aptly labels the “mid-cycle lull.”

Here is Bitcoin’s November 2024 cycle chart by CryptoCon:

Within this extended phase, Bitcoin typically maintains a steady position, hovering near a median price that’s approximately half of its previous all-time high. This distinctive mid-cycle lull serves as a harbinger of the imminent bull run, heralding a period of thrilling market dynamics.

It’s essential to underscore, as CryptoCon rightly does, that while these 4-year cycles exhibit a recurring pattern, pinpointing exact price levels and precise timing remains a complex undertaking, retaining an inherent element of unpredictability.

Current Scenario For Bitcoin’s November 2024 cycle

In accordance with the well-established model of Bitcoin’s November 2024 cycle, Bitcoin seems to have recently achieved its initial peak, signaling a transition into the anticipated mid-cycle lull phase. Historically, these interim periods of price stability have typically manifested around June, following a previous price bottom. Drawing insights from past patterns, CryptoCon confidently envisions an impending bullish surge set to kick off on November 28, 2024, followed by subsequent peaks and troughs forecasted for November 2025 and 2026, respectively. Looking further ahead, crypto enthusiasts can anticipate the arrival of the next mid-cycle lull around June 2027, as predicted by CryptoCon’s meticulous analysis of Bitcoin’s November 2024 cycle.

The Future of Bitcoin

CryptoCon’s insights have ignited the curiosity of both seasoned and novice investors. While the broader strokes of these 4-year cycles seem to endure, the nuances of Bitcoin’s price and timing are shrouded in unpredictability. The crypto market, as always, remains a realm of both risk and opportunity, where informed decisions are key to navigating the ever-evolving landscape.

As we inch closer to the anticipated November 2024 date, all eyes will be on Bitcoin, watching to see if CryptoCon’s theory plays out as expected. Whether you’re a seasoned holder or a curious newcomer, the crypto world’s next chapter promises to be an exciting one, filled with potential and uncertainty alike.

FAQs for Bitcoin’s November 2024 cycle

1. What is the significance of November 28, 2024, in Bitcoin’s cycles?

- November 28, 2024, holds importance in Bitcoin’s cycles, as historical data suggests that Bitcoin’s peaks and bottoms often align with this date, indicating potential market movements.

2. Who is CryptoCon, and what is his contribution to understanding Bitcoin cycles?

- CryptoCon is a renowned crypto analyst known for his “November 28th Cycles Theory.” He has highlighted the recurring 4-year cycles in Bitcoin’s behavior, with a specific focus on the date of Bitcoin’s first halving on Nov. 28, 2012.

3. What is the “mid-cycle lull,” and when does it occur in Bitcoin’s cycles?

- The “mid-cycle lull” is a phase where Bitcoin tends to stabilize around a median price, approximately half of its previous all-time high. This phase typically precedes a significant bull run and often occurs within the 4-year cycle.

4. Can Bitcoin’s exact price and timing be predicted using the cycle theory?

- While the broader 4-year cycles in Bitcoin’s behavior are observable, predicting precise price points and timing remains challenging and unpredictable, preserving an element of surprise in the market.

5. When can we expect the next significant bull run in Bitcoin, according to CryptoCon’s model?

- Based on CryptoCon’s analysis, a bull run is expected to kick off on November 28, 2024, with subsequent peaks and troughs projected for November 2025 and 2026, respectively.

6. What should investors keep in mind as they navigate the cryptocurrency market?

- Investors should remember that the crypto market is characterized by both risk and opportunity. Informed decisions, research, and a long-term perspective are essential when venturing into this dynamic space.

Conclusions

In summary, the cryptocurrency community is abuzz with anticipation for Bitcoin’s November 2024 cycle. CryptoCon’s invaluable insights into Bitcoin’s cyclic patterns, centered around the November 2024 date, provide a tantalizing peek into potential market dynamics. However, just as in any investment endeavor, exercising prudence and conducting thorough research around Bitcoin’s November 2024 cycle remains imperative. Keep a watchful eye on the ever-evolving crypto landscape, for it is here that the unfolding narrative of Bitcoin’s next chapter, guided by these intriguing cycles, will captivate us all.

Read More

Navigating Cryptocurrency Crashes: Safeguarding Your Investments in 4 Steps Amidst Volatile Market

Rune Crypto Success Unleashed: Your Epic Journey to 10X Wealth with the Ultimate 9-Step Roadmap

Unveiling the Hottest Cryptocurrency Presales 2023 | Exploring Top Picks and Exciting New Meme Coins