The world of cryptocurrency has had a profound global impact, completely transforming our perspective and interaction with money. Its disruptive nature has reshaped traditional financial systems, offering new avenues of exploration and possibilities for individuals and businesses alike. By considering the concepts of perplexity and burstiness, we can create written content that captivates readers with its intricacy and diverse sentence structures.

In this comprehensive guide, we embark on a captivating journey into the world of cryptocurrencies. Let us uncover the different types of digital currencies that have revolutionized the financial landscape. From trailblazing Bitcoin to versatile Ethereum, transformative Ripple, and the “silver” Litecoin, we shall explore the unique features and potential applications of each cryptocurrency. Prepare to delve into the depths of this fascinating realm and discover the endless possibilities it holds.

The Conventional Currency Vs Cryptocurrency

First, let’s understand the difference between Conventional Currency and Cryptocurrency

Conventional currency is the currency that is issued by the government of a country. This legal tender is backed by the government of the country that issues it, rather than a tangible good or commodity.

Cryptocurrency is a digital currency designed to work as a medium of exchange through a computer network that is fully secure due to the use of encryption techniques and that is not regulated by or dependent on any central authority, such as a government or bank, to uphold or maintain it. Cryptocurrency is also known as “crypto” or, “crypto-currency.”

Know the Cryptocurrency

When cryptocurrency is mentioned in the news or other sources, we find ourselves contemplating its essence. What exactly is cryptocurrency? How does it operate?

Cryptocurrency represents a digital payment system that operates independently of traditional banking institutions for transaction verification. It is an encrypted peer-to-peer system, empowering individuals to send and receive payments effortlessly across the globe.

The underlying foundation of cryptocurrency lies in blockchain technology, a decentralized ledger managed by a network of computers that meticulously maintain an identical copy of the database. Consequently, whenever cryptocurrency funds are transferred, these transactions are meticulously recorded in a public ledger, while the actual digital currency is stored securely in digital wallets.

The term “cryptocurrency” derives its name from its utilization of encryption to authenticate various transaction types, thereby ensuring robust security measures. In simpler terms, the storage and transmission of cryptocurrency data between wallets and public ledgers involves intricate coding processes. Encryption serves the fundamental purpose of furnishing comprehensive security and safeguarding.

Types of Cryptocurrency?

There are numerous types of cryptocurrencies. The first to emerge was Bitcoin, established in 2009 by Satoshi Nakamoto, an enigmatic innovator. Presently, it continues to hold the status of being the most renowned cryptocurrency.

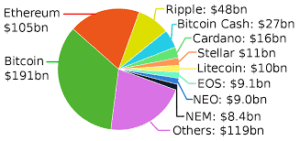

Additionally, there are several other widely recognized cryptocurrencies you can see on the market, such as Ripple, Ethereum, Litecoin, Cardano, Stellar, and Dash. Some noteworthy examples include EOS, NEO, and NEM, among others.

Let’s delve into an in-depth exploration of several renowned cryptocurrencies prevailing in the market, encompassing their pivotal attributes and Applications:

Bitcoin: The Pioneer of Cryptocurrencies

Bitcoin, the pioneering and well-known cryptocurrency, emerged as a game-changing force that fundamentally transformed the notion of digital currencies on a worldwide scale.

It is created by the enigmatic Satoshi Nakamoto and is based on blockchain technology, a decentralized peer-to-peer network

What truly sets Bitcoin apart are its inherent characteristics of security and transparency, which have propelled its adoption by investors and everyday users alike.

But here’s where Bitcoin gets even more fascinating. It comes with a captivating twist—a limited supply. Yes, you heard it right. There will only ever be a maximum of 21 million coins in existence. This scarcity factor has played a significant role in boosting its appeal and driving its value skyward over time. The fact that there’s a fixed number of coins available adds to the allure and contributes to its increasing value as the year’s roll by.

Key Features and Applications of Bitcoin

Bitcoin, a cryptocurrency of exceptional repute, boasts a plethora of commendable attributes. A pivotal strength resides within its decentralized fabric, endowing users with the capacity for direct transactions, bereft of intermediaries like conventional banks. This decentralized structure becomes the catalyst, empowering individuals and bestowing upon them an unparalleled dominion over their financial resources. Consequently, it kindles the embers of fiscal self-governance, lending credence to the veracity of this remarkable system.

Manifesting as a praiseworthy facet of Bitcoin is its staunch dedication to safeguarding anonymity. While the tapestry of transactions assumes meticulous documentation within the blockchain, the identities of the involved parties tend to exist under the aegis of pseudonyms, thereby preserving a veil of confidentiality. This inherent attribute, undoubtedly, serves as a beacon, luring individuals who prize discretion in their monetary pursuits towards the alluring realm of Bitcoin.

The bedrock of Bitcoin’s operations lies in the realm of cryptographic technology, which, in turn, enshrines the sanctity and integrity of transactions. By employing a labyrinthine web of algorithms and encryption techniques, this intricate system erects formidable barriers against the specter of unauthorized access and tampering, thereby fortifying the overall trustworthiness and reliability of the network.

Bitcoin, an entity that effortlessly wears the mantle of versatility, finds itself adorning a vast array of applications. Its multifaceted existence as a digital currency lends itself seamlessly to the realm of online purchases and cross-border remittances, providing an efficacious and cost-effective alternative to the traditional paradigms of payment. Furthermore, in an intriguing turn of events, Bitcoin emerges as an invaluable digital asset, one that individuals can embrace as a vessel for long-term investment objectives.

Moreover, it is worth highlighting the perspective held by certain individuals who perceive Bitcoin as a potent hedge against the conventional machinations of financial systems. The rationale lies in its capacity to retain value even during periods of economic uncertainty, thereby cementing its reputation as a bastion of stability amidst tumultuous tides.

Ethereum: Beyond Digital Currency

Ethereum stands out among cryptocurrencies due to its ability to facilitate intelligent contracts and decentralized applications (DApps). Devised by the brilliant mind of Vitalik Buterin, Ethereum has garnered substantial acclaim for its adaptability and inclination toward groundbreaking advancements. Its inherent currency, Ether (ETH), drives the network forward and serves as a medium of transaction within the extensive Ethereum ecosystem.

Key Features and Applications of Ethereum

Ethereum’s primary characteristic resides in its automated implementation of intelligent agreements.

These autonomous agreements obviate the necessity for intermediaries and facilitate a broad spectrum of applications, encompassing decentralized finance (DeFi), non-fungible tokens (NFTs), and decentralized exchanges (DEXs).

The Ethereum blockchain has evolved into a focal point for developers and entrepreneurs aspiring to construct innovative solutions on a decentralized platform.

Ripple: Transforming Cross-Border Payments

Ripple, often associated with its native digital currency, XRP, aims to revolutionize the traditional banking system, particularly in the context of cross-border payments. Unlike Bitcoin and Ethereum, Ripple does not rely on blockchain technology. Instead, it utilizes a unique consensus algorithm known as the Ripple Protocol Consensus Algorithm (RPCA).

Key Features and Applications

Ripple’s standout feature is its ability to facilitate fast and cost-effective cross-border transactions. By connecting financial institutions through its proprietary network, Ripple enables seamless transfers of various currencies. Its payment protocol, Interledger Protocol (ILP), enhances interoperability between different payment networks, making it an attractive option for banks and remittance services. Ripple’s technology has the potential to disrupt the traditional correspondent banking system and streamline international transactions.

Litecoin: The Silver to Bitcoin’s Gold

Often referred to as the “silver” to Bitcoin’s “gold,” Litecoin shares many similarities with its predecessor. Created by Charlie Lee, a former Google engineer, Litecoin aims to improve upon Bitcoin’s limitations by offering faster transaction times and lower fees. It operates on similar blockchain technology but with a few key differences.

Key Features and Applications of Litecoin

Litecoin possesses a prominent characteristic in the form of its accelerated block generation time when compared to Bitcoin. This attribute facilitates swift transaction confirmations, rendering it more suitable for day-to-day financial dealings.

Furthermore, Litecoin has garnered significant acclaim as a vehicle for diversifying one’s cryptocurrency holdings and serves as a testing ground for the implementation of novel technologies prior to their integration into Bitcoin.

Exploring Other Cryptocurrencies

While Bitcoin, Ethereum, Ripple, and Litecoin stand among the most renowned digital currencies, the landscape of virtual monetary systems is extensive and continuously expanding. Numerous other cryptocurrencies offer unique features and cater to specific use cases. Here are some notable examples:

- Stellar (XLM): focuses on facilitating low-cost cross-border transactions for individuals and institutions.

- Cardano (ADA): Aims to create a secure and scalable platform for the development of decentralized applications and smart contracts.

- Polkadot (DOT): A multi-chain network that enables different blockchains to interoperate and securely share information.

- Chainlink (LINK): Provides decentralized Oracle services, connecting smart contracts with real-world data and external APIs.

- Binance Coin (BNB): The native cryptocurrency of the Binance exchange, used for transaction fees and access to various features on the platform.

Who regulates The Crypto Currencies?

Cryptocurrencies lack government or agency regulation and do not rely on intermediaries for transactions. Instead, these digital assets are managed by decentralized networks of free and open-source computers. Originally conceived as an alternative payment solution for online transactions, cryptocurrencies have not yet gained widespread acceptance among companies and customers. Presently, their unreliability hinders their suitability as viable payment methods.

Conclusions :

In this article, we have discussed cryptocurrency, conventional currency vs. cryptocurrencies, types of cryptocurrencies and their key features and applications, and who regulates cryptocurrencies. Please note that, like any other investment sector, there is a risk involved in the investment in cryptocurrency. You must do your own research before taking any decisions, and for this, you need to get updates from reliable sources. You should go through all the articles on this website before investing in cryptocurrency

People also read it :

- What is a smart contract? Unlocking the Potential of smart contracts: A Beginner’s Guide

- Cryptocurrency for beginners – What is Cryptocurrency? How does it work?

- BlackRock’s entry into the Cryptocurrency space: A game changer for Bitcoin and other cryptocurrencies?

- What is Cryptocurrency? How does it work?-Cryptocurrency for beginners

- A Foolproof Guide To Bitcoin Mining