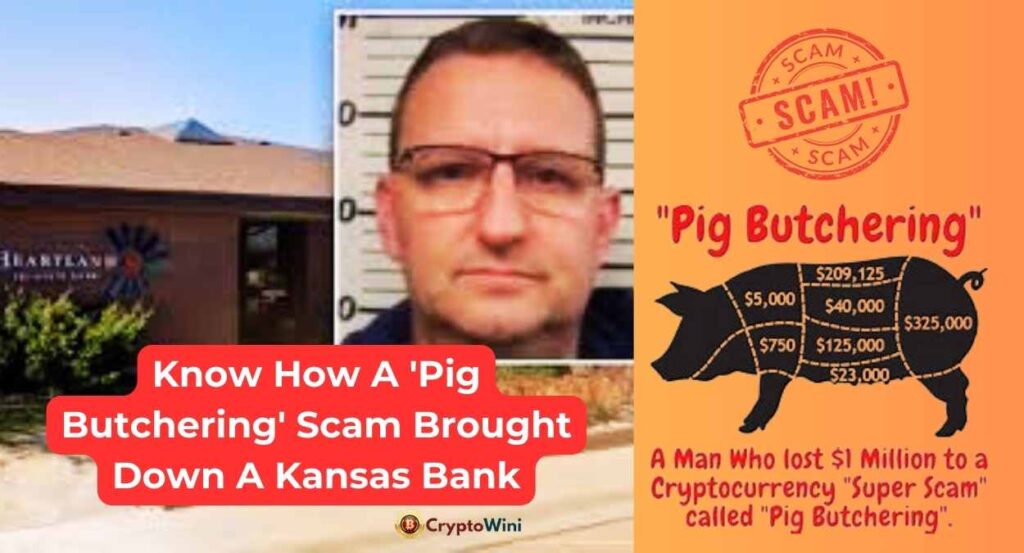

How a ‘Pig Butchering’ Cryptocurrency Scam Brought Down a Kansas Bank

In a shocking turn of events, the quiet town of Elkhart, Kansas, found itself at the center of a multi-million-dollar cryptocurrency scam that brought down a local bank and sent its former CEO to prison. Shan Hanes, once a respected figure in the community and banking industry, fell victim to a sophisticated “pig butchering” scheme, leading him to embezzle a staggering $47 million from Heartland Tri-State Bank. This unprecedented case of fraud not only devastated the small town’s economy but also shed light on the growing threat of cryptocurrency-related scams targeting even the most unlikely victims.

The story of Hanes’ downfall serves as a stark reminder of how greed and desperation can cloud judgment, even for those in positions of trust. From his initial personal investments to the massive wire transfers that ultimately sank the bank, we’ll explore the intricate details of this case, its far-reaching consequences, and the lessons it holds for both individuals and financial institutions in the age of digital currencies.

What is Pig Butchering scam ?

A pig butchering scam is a devious cryptocurrency fraud that’s taking the digital world by storm. It starts innocently enough – scammers befriend victims online, often through dating apps or social media. They slowly build trust, painting themselves as successful investors. Then comes the hook: they introduce a “lucrative” crypto investment opportunity. Victims are encouraged to invest small amounts at first, seeing fake returns to boost confidence. As trust grows, so do the investments. But it’s all a mirage. When victims try to cash out, they’re hit with fees or told to invest more to unlock funds. In the end, the scammer disappears, leaving the victim financially and emotionally gutted.

The Rise and Fall of Shan Hanes

A Pillar of the Community

Shan Hanes was no ordinary small-town banker. For years, he’d been a fixture in Elkhart, a community of just 2,000 souls nestled in the southwestern corner of Kansas. Neighbors knew him as a “good guy” who pitched in when folks needed help and preached at the local church. His influence extended far beyond the town limits, too.

Hanes had carved out a reputation as a voice for community banking. He’d served on the board of the American Bankers Association and chaired the Kansas Bankers Association. Heck, he’d even testified before Congress about the importance of small-town financial institutions. To most, he seemed like the last person you’d expect to get caught up in a multi-million-dollar scam.

The Lure of Crypto Riches

But beneath that respectable exterior, something had changed. In late 2022, Hanes got hooked by a “pig butchering” scheme – a nasty bit of fraud where scammers convince victims to invest in fake cryptocurrency opportunities, then steal everything.

At first, Hanes used his own cash. But as the promises of big returns grew, so did his desperation. He dipped into a daughter’s college fund for $60,000. He swiped $40,000 from his church and $10,000 from a local investment club. Still not enough.

That’s when things went from bad to catastrophic.

The $47 Million Heist

A Bank Bled Dry

In May 2023, Hanes crossed a line he could never uncross. He started wiring money directly from Heartland Tri-State Bank to the scammers’ crypto wallets. What began as a “modest” $5,000 transfer quickly spiraled out of control:

- May 30: $1.5 million

- May 31: Another $1.5 million

- June 3: Two transfers totaling $6.7 million

- Mid-June: A whopping $10 million in one go

- Days later: Another $3.3 million

In just eight weeks, Hanes had drained $47 million from the bank’s coffers. To pull it off, he manipulated employees and circumvented the bank’s own wire transfer policies. His position as CEO and standing in the community made people reluctant to question these massive, irregular transactions.

The House of Cards Collapses

By early July, Hanes was desperate. He approached his neighbor, Brian Mitchell, with an unbelievable request: a $12 million loan for just ten days, promising a $1 million return. Mitchell, smelling a rat, refused and warned Hanes he was caught in a scam.

But it was too late. Within weeks, the truth came out. Hanes was fired, and on July 28, 2023, Heartland Tri-State Bank was shuttered by state regulators and taken over by the FDIC. It was one of only five U.S. banks to fail that year.

The Aftermath

A Community Shattered

The bank’s collapse sent shockwaves through Elkhart. While depositors were protected, shareholders saw their investments evaporate overnight. Brian Mitchell described the devastation:

- People lost 70-80% of their retirement savings

- One woman struggled to afford a nursing home for her 93-year-old mother

- Another resident could no longer afford to retire

The betrayal cut deep in a town where neighbors had trusted Hanes for years.

Justice Served

In February 2024, federal prosecutors charged Hanes with embezzlement. He pleaded guilty to a single count in May. On August 21, 2024, U.S. District Judge John Broomes handed down a sentence even harsher than prosecutors sought: 24 years and 5 months in prison.

During sentencing, victims described the impact of Hanes’ crimes. The former CEO offered only a brief “Sorry” without making eye contact. Judge Broomes, addressing both Hanes and the community, said:

“If you were that intelligent, you would have stopped this… I want you to forgive Shan. I know that he’s hurt you, but I want you to move on and find some joy in your life. Let me discipline him.”

Lessons from the Heartland

The Dangers of Crypto Scams

The Heartland Tri-State Bank case highlights the sophistication and devastating potential of cryptocurrency scams:

- Anyone can be a target: Even experienced bankers can fall prey

- Escalation is common: Victims are pressured to invest more and more

- Emotional manipulation: Scammers play on greed and fear of missing out

- Use of legitimate-seeming platforms: WhatsApp was used to communicate

- Promises of quick, massive returns: Too good to be true is often just that

Safeguarding Financial Institutions

The case also exposes vulnerabilities in banking oversight:

- Need for stronger internal controls: Multiple large transfers should trigger automatic reviews

- Importance of questioning authority: Employees must feel empowered to raise red flags

- Regular audits are crucial: External checks might have caught the fraud earlier

- Cryptocurrency awareness training: Banks need to educate staff on these emerging threats

The Bigger Picture

Hanes’ case is part of a broader trend of cryptocurrency-related fraud. In 2023, the FBI’s Internet Crime Complaint Center reported over $3.5 billion in losses from crypto investment scams. As digital currencies gain mainstream acceptance, criminals are finding new ways to exploit the technology and human psychology.

FAQs

Q. What is a “pig butchering” cryptocurrency scam?

A. A pig butchering scam is where fraudsters convince victims to invest in fake cryptocurrency opportunities, gradually building trust and encouraging larger investments before stealing all the funds.

Q. How much money did Shan Hanes embezzle from Heartland Tri-State Bank?

A. Shan Hanes embezzled $47 million from Heartland Tri-State Bank over a period of just eight weeks in 2023.

Q. What sentence did Shan Hanes receive for his crimes?

A. Shan Hanes was sentenced to 24 years and 5 months in federal prison for embezzlement.

Q. How did the bank’s failure impact the local community?

A. The bank’s failure wiped out shareholders’ investments, affecting many residents’ retirement savings and financial stability in the small town of Elkhart, Kansas.

Q. Were bank depositors protected when Heartland Tri-State Bank failed?

A. Yes, depositors did not lose money as their accounts were assumed by Dream First Bank, National Association, of Syracuse, Kansas.

Q. What red flags should banks watch for to prevent similar embezzlement schemes?

A. Banks should be alert to unusually large or frequent wire transfers, violations of internal policies, and any pressure from executives to circumvent normal procedures.

Q. How can individuals protect themselves from cryptocurrency investment scams?

A. Be skeptical of promises of high returns with little risk, never invest money you can’t afford to lose, and thoroughly research any investment opportunity before committing funds.

Conclusion

The fall of Shan Hanes and Heartland Tri-State Bank serves as a cautionary tale for our times. It shows how cryptocurrency scams can devastate not just individuals, but entire communities. The case highlights the need for heightened vigilance, both personal and institutional, in the face of evolving financial threats.

As we move further into the digital age, the lessons from this small Kansas town resonate far and wide. They remind us that financial literacy, healthy skepticism, and robust oversight are more crucial than ever. The story of Elkhart is a wake-up call – one that the banking industry, regulators, and everyday investors would do well to heed.

Disclaimer:

The information provided on CryptoWini is based on media reports and is for educational purposes only. We cannot guarantee the authenticity of the allegations presented. We do not offer financial advice and strongly urge readers to conduct their own research and consult with qualified professionals before making any investment decision

Also Read :

Cryptocurrency Money Laundering in Dubai Real Estate | Fraudsters Exploit Cryptocurrency

INDIA: Cryptocurrency SCAM – Explore How a Pune Resident Lost 1.27 Crore to a Cryptocurrency FRAUD!

Investigating the Seizure of Rs 1,144 Crore in Crypto Fraud Cases: Unveiling the Complexities